Corporate Governance

- Basic Policy

- Efforts to Strengthen the Governance Capacity

- Corporate Governance Structure

- Selection Criteria for Directors

- Analysis and Evaluation of Effectiveness of the Board of Directors

- Standards for Independence of Outside Directors/Audit & Supervisory Board Members

- Support Framework for Outside Directors/Outside Audit & Supervisory Board Members

- Remuneration of Members of the Board, etc.

- Policy on Strategic Shareholdings

- Basic Policy for the Internal Control System and Status of Operation

Basic Policy

Guided by our Corporate Philosophy, Kaneka aims to achieve sustainable growth, improve medium- to long-term corporate value, and build trust among all stakeholders, including shareholders, investors, customers, local communities, vendors, and employees, realizing optimum corporate governance to fulfill our social responsibility.

Kaneka believes that a working corporate governance function is extremely important for realizing diverse, global business growth and maintaining the optimal allocation of corporate resources to the R&D, production and sales activities that support that growth. It is also essential for realizing sustainable growth together with the medium- to long-term improvement of corporate value. From that perspective, Kaneka is working to enhance corporate governance, both to ensure transparency and fairness in decision-making and to build more dynamic management through swift, bold decisions. Kaneka believes the following basic items are particularly important in those efforts.

- Respecting and ensuring the equality of shareholder rights

- Collaborating with other stakeholders in the value-creation process

- Ensuring transparency through the timely, appropriate disclosure of information

- Strengthening the oversight and strategic recommendation functions of the Board of Directors by leveraging the independence and insight of its independent member of the board

- Appropriately communicating and encouraging understanding of Kaneka’s corporate philosophy and policies among all stakeholders

- Conducting a constructive dialogue with shareholders based on an understanding of Kaneka’s corporate policies

Efforts to Strengthen the Governance Capacity

| 2006– | 2011– | 2021– | |

|---|---|---|---|

| Corporate Philosophy | 2009 Established the “Declaration of Kaneka United” | 2018 Established the “ESG Charter” | |

| Separation of management and execution | 2006 Introduced the executive officer system 2006 Changed the number of directors from 21 to 13 |

||

| Outside directors | 2011 Appointed an outside director 2015 Increased the number of outside directors from 1 to 2 2020 Increased the number of outside directors from 2 to 4 |

2022 Appointment of one female director 2023 Increased the number of female directors from 1 to 2 |

|

| Committees | 2015 Established the Nomination & Compensation Advisory Committee 2015 Established the Independent Outside Directors’ Meeting |

2021 Majority of the Nomination & Compensation Advisory Committee is the Independent Outside Directors | |

| Internal control system | 2006 Formulated the Basic Policy on Internal Control System | ||

| Corporate governance | 2015 Formulated the Basic Policy on Corporate Governance | ||

| Independence criteria for outside directors | 2013 Formulated the Criteria for Independence of Outside Directors | ||

| Effectiveness evaluation | 2016 Commenced the effectiveness evaluation on the Board of Directors |

Corporate Governance Structure

Diagram of Corporate Governance System

Organizational Design

We currently have four independent outside directors and two independent outside Audit & Supervisory Board Members. Since both the overseeing of business operations by the Board of Directors and auditing by the Audit & Supervisory Board are functioning well, Kaneka has chosen to be a Company with Audit & Supervisory Board under the Companies Act.

| Main items | |

|---|---|

| Organizational structure | Company with Audit & Supervisory Board |

| Term of office of directors | 1 year |

| Adopted executive officer system | Yes |

| Organization that assists the president in decision making | Management Committee |

| Voluntary advisory body to the Board of Directors | Nomination & Compensation Advisory Committee |

| Other important bodies | Independent Outside Directors’ Meeting |

Directors and the Board of Directors

The Board of Directors seeks to ensure efficient and effective corporate governance in order to realize the company’s sustainable growth and increase corporate value in the medium- to long-term.

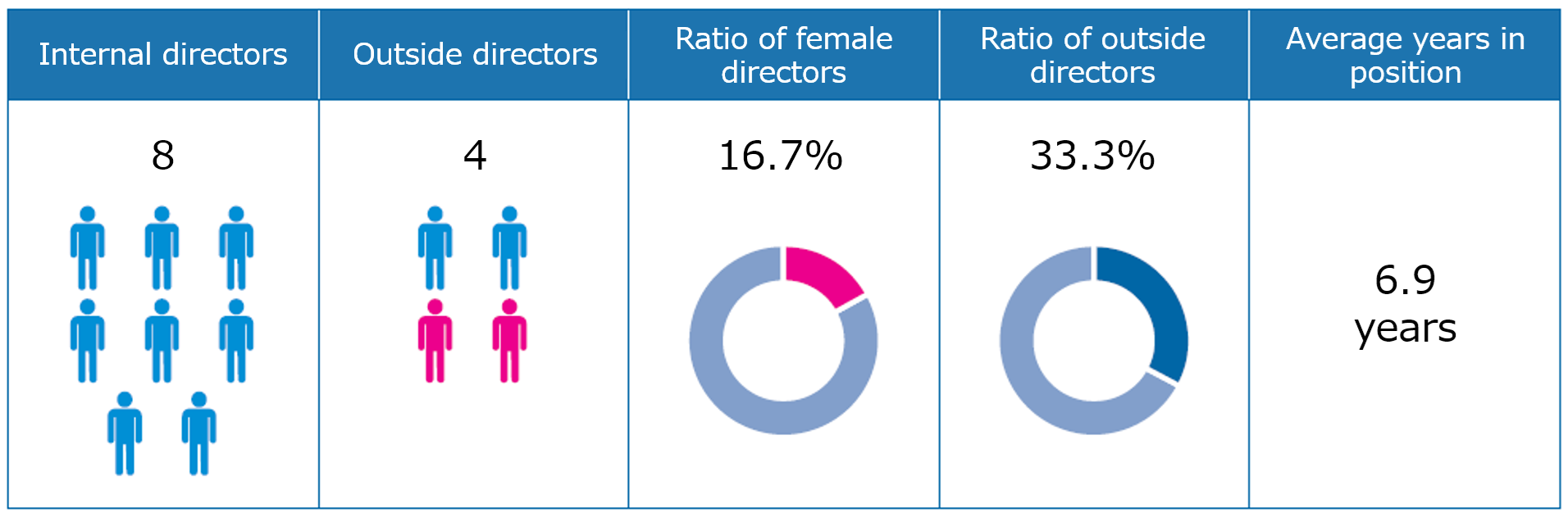

The Board of Directors exercises its oversight functions on overall management to ensure fairness and transparency, as well as to appoint management positions, evaluate and determine remuneration, evaluate serious risks and determine strategies to counter them, and make the best decisions on important business operations. The Board of Directors makes resolutions on important matters related to the management of the Kaneka Group after deliberation by the Management Committee, which includes the president. There are at most 13 members on the Board of Directors. Of these, four are independent outside directors, in principle, to strengthen the oversight function. Directors serve for a period of one year to clearly define management responsibilities.

Composition of the Board of Directors

Note: The above details are true as of the end of the 100th Annual General Meeting of Shareholders held on June 27, 2024.

The Board of Directors met 14 times in fiscal 2023. (The rate of attendance by Directors and Audit & Supervisory Board Members was 100.0%). Based on the rules of the Board of Directors, it discussed and decided on the mid-term management plan, annual budget, financial policy, key personnel, quarterly/year-end accounts, and strategic investments. The Board of Directors also received and discussed reports on each business division with regard to progress on the mid-term management plan and the monitoring of issues.

Audit & Supervisory Board Members and the Audit & Supervisory Board

Audit & Supervisory Board Members and the Audit & Supervisory Board seek to ensure healthy and sustainable corporate growth and to establish a structure with good corporate governance that can gain social trust by checking on the performance of directors in regard to their duties.

The Audit & Supervisory Board comprises four members, two of whom are independent outside members, and performs audits in coordination with the Accounting Auditor and the Internal Control Department. Audit & Supervisory Board Members are given space to periodically exchange views with the representative director, and monitor the state of business operations when necessary, by attending key meetings of the Board of Directors and those of the Management Committee, which decides on the implementation of important matters, as well as division head meetings.

Nomination & Compensation Advisory Committee/Independent Outside Directors’ Meeting

We have established the Nomination & Compensation Advisory Committee and Independent Outside Directors’ Meeting. The Nomination & Compensation Advisory Committee discusses remuneration of Directors, and candidates for Directors and Audit & Supervisory Board Members, and reports them to the Board of Directors. The Independent Outside Directors’ Meeting discusses the effectiveness of the Board of Directors to report to the Chairman of the Board of Directors. In order to increase neutrality, the majority of the Nomination & Compensation Advisory Committee are the independent outside directors.

Implementation of Business Operations

Kaneka has adopted the executive officer system to harmonize the oversight function of directors with the implementation function of business operations, which also facilitates decision-making and clearly defines roles. The Board of Directors decides on key management strategies and business operations of the entire Kaneka Group, while executive officers handle business operations in their respective areas of responsibility. The Executive Officers’ Meeting is held monthly to share management policies and issues with the aim of achieving management goals speedily. Division heads, including executive officers appointed by the Board of Directors, are given extensive authority over daily business execution. Monthly division head meetings are held to enable the directors and Audit & Supervisory Board Members to directly hear progress reports from each division head. The Internal Control Department evaluates the effectiveness of internal control and conducts an internal audit.

Selection Criteria for Directors

At Kaneka, directors are selected by the Board of Directors, on the basis of character, judgment, expertise and experience as well as ethics, after deliberation by the Nomination & Compensation Advisory Committee, which is comprised of directors and independent outside directors.

We are expanding diverse businesses globally. In order for the Board of Directors to make accurate and prompt decisions and supervise these corporate activities, we place great importance on appointing directors with different backgrounds such as diverse knowledge, experience, and expertise. Specifically, we expect knowledge, experience, and expertise related to business, global, technology, diversity and corporate & governance. We also believe that the Board of Directors as a whole has well-balanced knowledge, experience, and expertise, and is composed of an appropriate number of people.

In selecting directors, no restrictions are made in terms of gender, age or nationality.

Skills Matrix of the Members of the Board

| Name | Position in the Company | Fiscal 2023 attendance at Meetings of the Board of Directors | Knowledge, experience, and expertise | ||||

|---|---|---|---|---|---|---|---|

| Business | Global | Technology | Diversity | Corporate & Governance | |||

| Kimikazu Sugawara | Chairman of the Board (Representative Director) |

100% | 〇 | 〇 | 〇 | 〇 | |

| Kazuhiko Fujii | President (Representative Director) | 100% | 〇 | 〇 | 〇 | 〇 | |

| Shinichiro Kametaka | Member of the Board, Executive Vice President | 100% | 〇 | 〇 | 〇 | 〇 | |

| Mamoru Kadokura | Member of the Board, Executive Vice President | 100% | 〇 | 〇 | 〇 | 〇 | |

| Katsunobu Doro | Member of the Board, Managing Executive Officer | 100% | 〇 | 〇 | 〇 | ||

| Jun Enoki | Member of the Board, Managing Executive Officer | 100% | 〇 | 〇 | 〇 | 〇 | |

| Toshio Komori | Member of the Board, Managing Executive Officer | 100% | 〇 | 〇 | 〇 | 〇 | |

| Masaaki Kimura | Member of the Board, Managing Executive Officer | ー | 〇 | 〇 | 〇 | 〇 | |

| Mamoru Mohri | Independent Member of the Board | 100% | 〇 | 〇 | 〇 | 〇 | |

| Jun Yokota | Independent Member of the Board | 100% | 〇 | 〇 | 〇 | ||

| Yuko Sasakawa | Independent Member of the Board | 100% | 〇 | 〇 | 〇 | ||

| Hiromi Miyake | Independent Member of the Board | 100% | 〇 | 〇 | 〇 | ||

Note:The above details are true as of the end of the 100th Annual General Meeting of Shareholders held on June 27, 2024.

The table above does not show all the skills of each Member of the Board.

Analysis and Evaluation of Effectiveness of the Board of Directors

Each year, Kaneka implements an analysis and evaluation of the effectiveness of the Board of Directors, and discloses a summary of the evaluation results. Specifically, the Chairman of the Board of Directors periodically receives reports from the Independent Outside Directors’ Meeting and opinions from the internal directors.

Based on these reports, the current status of operations of the Board is evaluated. In the evaluation process in fiscal 2023, the Independent Outside Directors’ Meeting held discussions focusing on the operation of the Board of Directors (number of meetings held, frequency, length, contents of information provided beforehand, contents of agendas, deliberations, etc.), role of outside directors, information provision to outside directors, and risk management. Based on the discussion results, the Board of Directors conducted a self-evaluation. As a result, it has been confirmed that the Board of Directors functions effectively in making decisions on important matters for the Group such as risk management and supervising business execution. We will continue to enhance the effectiveness of our Board of Directors through effectiveness evaluations.

Standards for Independence of Outside Directors/Audit & Supervisory Board Members

We have defined the Standards for Independence of Outside Directors/Audit & Supervisory Board Members to guarantee the independence of independent outside directors and Audit & Supervisory Board Members in practice. The standards are disclosed in our notice of convocation of general meeting of shareholders, corporate governance report, etc.

Support Framework for Outside Directors/Outside Audit & Supervisory Board Members

For outside directors, the secretariat of the Board of Directors seeks to provide full explanations of the background, purpose, and content of proposed agenda items for Board meetings in advance. Outside directors attend Board meetings and make appropriate remarks based on their wealth of knowledge. They also receive monthly business reports from directors and share opinions as appropriate. In addition, they meet regularly with the representative directors and attend meetings of the Nomination & Compensation Advisory Committee and the Independent Outside Directors’ Meeting to exchange views.

Outside Audit & Supervisory Board Members attend meetings of the Board of Directors and the Audit & Supervisory Board, where they make appropriate remarks. They also receive monthly reports from the full-time Audit & Supervisory Board Members on auditing operations, exchanging views and discussing critical matters. Furthermore, they meet with the representative directors and attend the Independent Outside Directors’ Meeting to exchange opinions. We have established a secretariat for the Audit & Supervisory Board and appointed assistants to support Board Members in their duties.

Remuneration of Members of the Board, etc.

Matters relating to decision policies relating to the details of individual remuneration, etc., of Members of the Board.

・How this policy is determined

The Company decided on this policy by resolution of the Board of Directors held on February 9, 2021 following deliberation by the Nomination & Compensation Advisory Committee.

・Basic policy

The remuneration of our directors is appropriate, fair, and balanced. It aligns to the medium- to long-term interests of shareholders, increasing the motivation of Members of the Board toward maximizing the Company’s corporate value.

Remuneration for internal directors consists of monthly remuneration as fixed remuneration, bonuses as performance-linked remuneration, and stock option remuneration as non-monetary remuneration. Individual remuneration is determined according to the job responsibilities of each individual. For outside directors, only monthly remuneration is provided as fixed remuneration.

Total Amount of Remuneration for Directors and Audit & Supervisory Board Members

| Category | Personnel eligible for payment | Total amount paid | Total amount by type of remuneration | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration (bonus) | Non-monetary remuneration (stock option remuneration) | |||

| Directors (Of which, outside directors) |

14 (5) |

706 million yen (68 million yen) |

547 million yen (68 million yen) |

110 million yen (–) |

49 million yen (–) |

| Audit & Supervisory Board Members (Of which, outside Audit & Supervisory Board Members) |

5 (2) |

82 million yen (34 million yen) |

82 million yen (34 million yen) |

– | – |

Note:Amounts are rounded down to the nearest unit.

The amount for non-monetary remuneration (stock option remuneration) 49 million yen is the cost amount recorded for the most recent stock acquisition rights granted to eight directors excluding outside directors.

Policy on Strategic Shareholdings

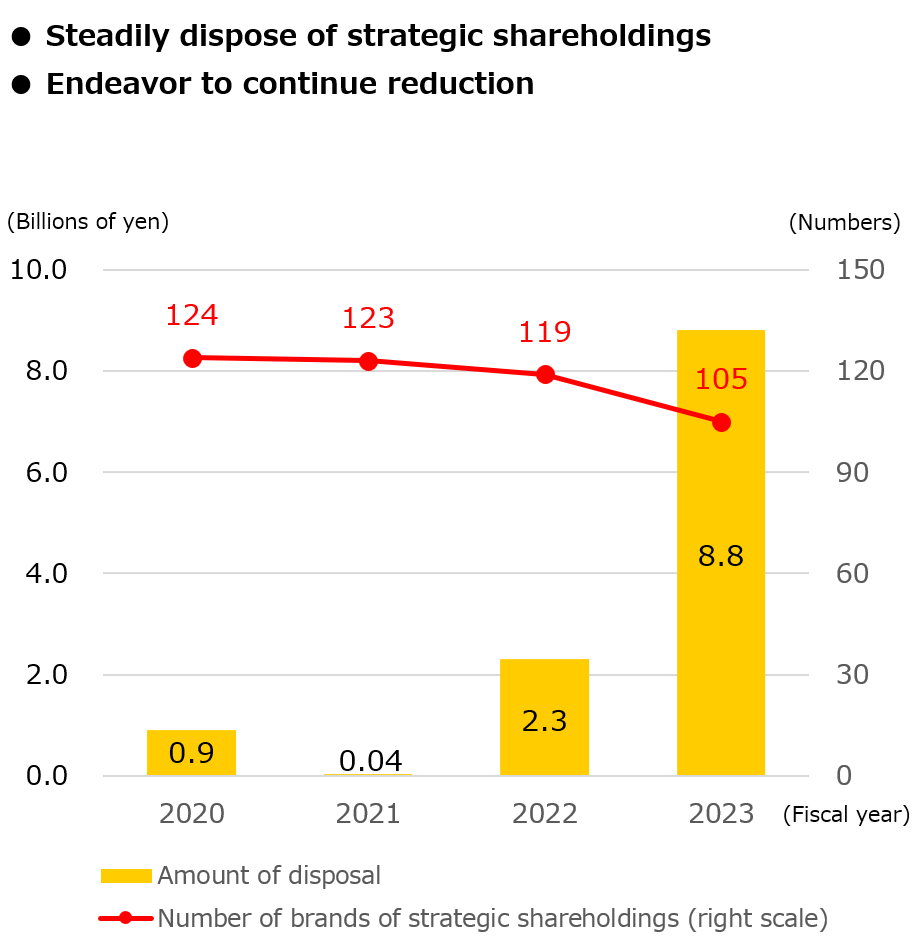

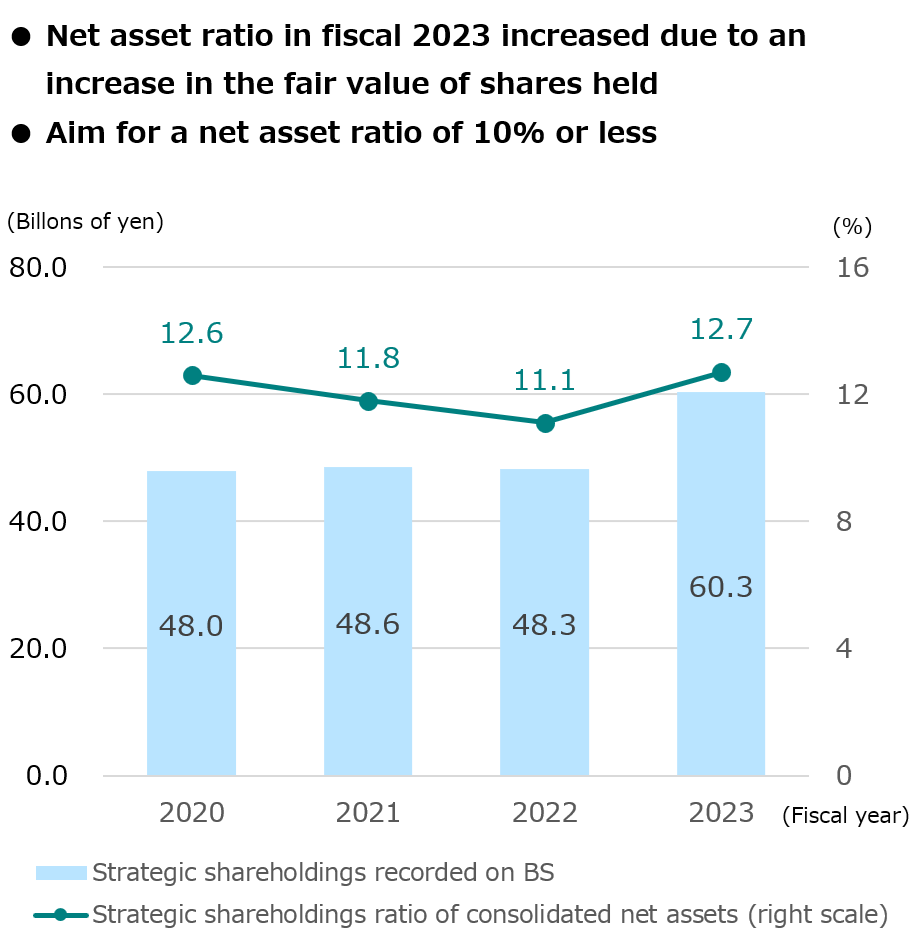

Kaneka holds the minimum number of strategic shareholdings necessary for maintaining and strengthening business relationships, business alliances, and capital alliances.

Each year we periodically review our strategic shareholdings after comprehensively assessing the appropriateness of the purpose of the holdings and the economic rationale in terms of the returns and risks associated with such holdings. When we determine that a holding is of low necessity, we reduce the number of shares that we hold. Each year, we report on these initiatives to the Board of Directors and disclose an overview of them. In fiscal 2023, we sold 17 listed stocks including partial sales as a result of the assessment described above. In addition, the exercise of voting rights pertaining to the shares held by the policy will be carried out after determining the approval or disapproval of each individual proposal after setting the exercise criteria.

Strategic Shareholdings

| Fiscal 2020 | Fiscal 2021 | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 | |

|---|---|---|---|---|---|

| Number of listed company stocks sold | 4 | 3 | 4 | 17 | 8(*) |

| Total amount sold related to decrease in number of shares (million yen) | 859 | 36 | 2,283 | 8,834 | 2,801 |

*Figures for fiscal 2024 are up to the 3rd quarter

Basic Policy for the Internal Control System and Status of Operation

The Company has established a Basic Policy for the Internal Control System by resolution of the Board of Directors. We periodically assess and review this policy as appropriate to ensure that our internal control system is effective. In fiscal 2023, we confirmed the status of operations with respect to (1) the compliance system and risk management system, (2) the system for the efficient performance of duties by directors, and (3) the system for management of subsidiaries and (4) the system for auditing by Audit & Supervisory Board Members.